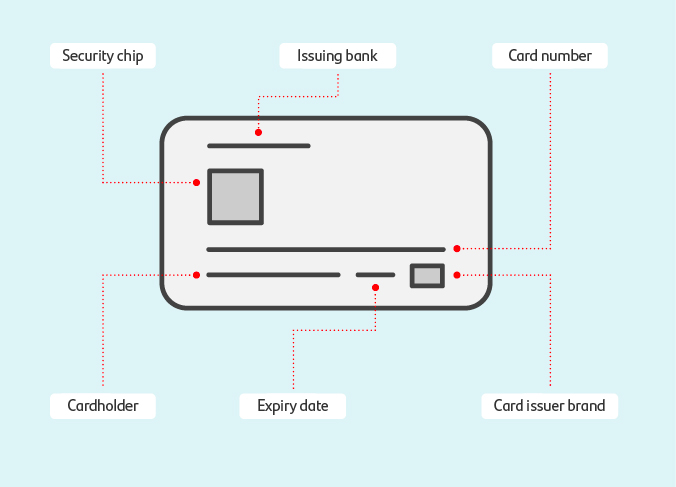

Although there are different types of credit cards, all credit cards have the same structure. They contain certain information, part of which is stored visibly, the other part invisibly.

The format of a credit card is called a check card format and is identical to that of an EC card, health insurance card, or driver’s license. The corresponding international standard is ISO/IEC 7810 and defines identity documents. The credit card corresponds to the ID-1 format with the dimensions 85.60mm x 53.98mm.

Data on the front

Contents

- the credit card number, which always has 16 digits, except for American Express cards (15 digits)

- the BIN code (Bank Identification Number) of the credit card issuer, printed in small print under the first four digits of the credit card number

- the month of issue of the credit card, indicated by VALID FROM and then the month and year in two digits

- the period of validity of the credit card, which is marked UNTIL END and, like the month of issue, is marked with two digits for month and year

- the name of the credit card holder

- VISA, MasterCard or American Express, depending on the credit card company There are also other card companies, but these are the three most frequently represented credit card companies in Germany. With VISA and MasterCard you can also pay in many shops and stores, with AMEX (American Express) this is less common.

Data on the back

- On the back of the card is the magnetic strip on which the check digits CVC1 and CVV2 are not visibly stored,

- the handwritten signature that must be made before use so that the card can be used at all or has the corresponding validity,

- the CVC, or credit card verification number,

- Details of the credit card issuer, such as the service number in case of loss of card (which is perhaps best written down somewhere BEFORE loss) and the address of the credit card issuer

- Other information printed there by the issuer of the credit card, which may vary considerably according to the type of card, the type of credit card in use or the type of prepaid credit card (credit card on credit basis, also called prepaid credit card)

Non-visible credit card data

If the credit card has a PIN, you can also use the card to withdraw cash from ATMs. For security reasons, the PIN is not stored on the card, but is requested online.

Which credit card data is required when and how?

- The credit card verification number, the CVC, is required for payments on the Internet. This is always a three-digit number and is stated on the back of the credit card.

- The PIN, the secret number, is required for withdrawing money from ATMs. The PIN is not given anywhere on the credit card, but was sent by post from the credit card issuer to the credit card holder.

- For payments on site in shops, the signature is required. Before using the credit card for the first time, it must be entered on the back of the credit card in the space provided.

here you can generate your fake credit card or a BIN code